High Returns From Low Risk

A Remarkable Stock Market Paradox

The Book

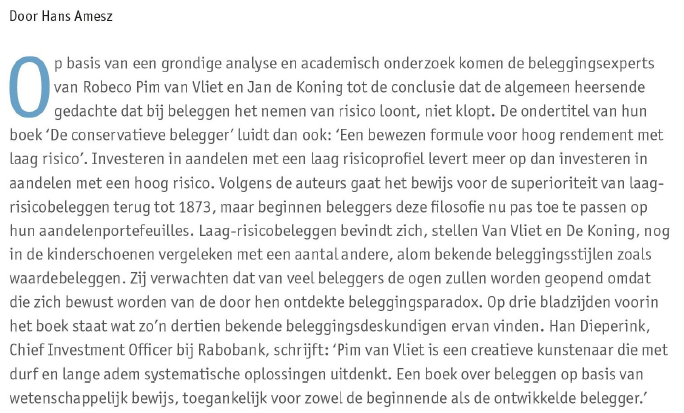

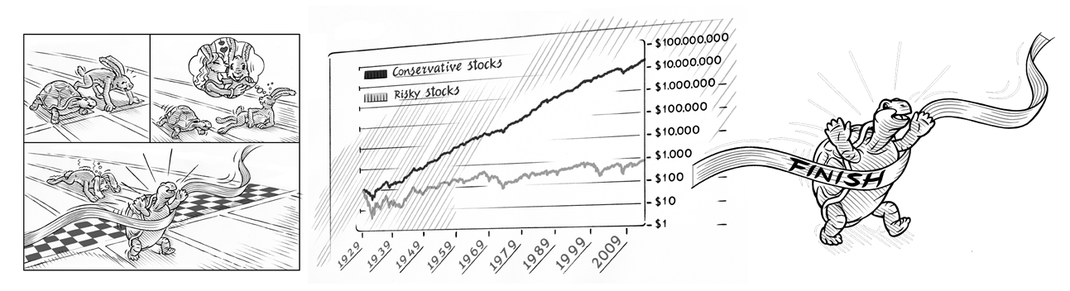

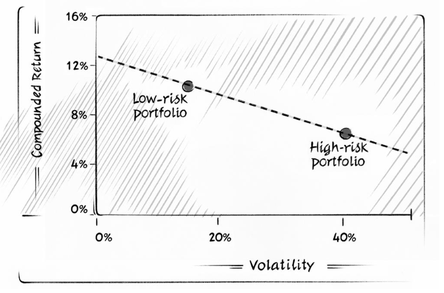

For generations investors have believed that risk and return are inseparable. But is this really true? In High Returns from Low Risk, Pim van Vliet, founder and fund manager of multi-billion Conservative Equity funds at Robeco and expert in the field of low-risk investing, combines the latest research with stock market data going back to 1929 to prove that investing in low-risk stocks gives surprisingly high returns, significantly better than those generated by high-risk stocks. Together with head of Quant Client Portfolio Management Jan de Koning, he presents this counterintuitive story as a modern upbeat stock market equivalent of ‘the tortoise and the hare’.

This book helps you to construct your own low-risk portfolio, select the right ETF or to find an active low-risk fund in order to profit from this paradox. And it explains why investing in low-risk stocks works and will continue to work, even once more people become aware of the paradox. It’s also a personal story, one that links our human nature and behavior to a prudent and successful investment formula. High Returns from Low Risk gives all the tools one needs to achieve excellent, long-term investment results. The book is available in English, German, French, Spanish and is published in Dutch and simplified Chinese as well.

Praise for the book

"The low-risk effect, that is the idea that historically, unlike many well-known theories, average return across stocks doesn't appear to go up with most standard measures of risk, is one of the most important 'anomalies' in modern finance. Pim van Vliet is one of the pioneers in studying this effect and using it to improve investor portfolios. Anyone interested in systematic equity investing should carefully read this important book."

Clifford S. Asness, Founder, Managing Principal and Chief Investment Officer at AQR Capital Management, USA

“Pim van Vliet has been a pioneer in turning academic insights on the low risk equity anomaly into a multi-billion investment portfolio. This book presents his magnum opus in a clear and powerful way, shedding light on low risk investing for anyone interested in equity investing, regardless of their quantitative background. It’s definitely a worthy read.”

Gerben de Zwart, Head of Quantitative Equities, APG Asset Management, The Netherlands

"I loved reading the book. It’s educational, humble, funny and philosophical; quite rare attributes for a financial book. In today's world where individuals will have to take more and more responsibility for their savings, this book serves a need: providing sound and pragmatic advice about how to manage one’s savings. Furthermore, this book puts forward an inconvenient truth about investment that is close to my heart: more risk doesn’t necessarily mean more return. On the contrary, it is sound and pro-active risk management that permits investment portfolios to have sustainable long-term returns"

Fiona Frick, CEO Unigestion, Switzerland

"Pim van Vliet’s experience as one of pioneers of low volatility investing gives him unique insight into one of the most fascinating economic anomalies of our time. The idea that risk, properly defined, generates a positive return, is one of those ideas that becomes even more profound when we learn it is not true. There is no cosmic risk karma that pays people for taking risk, and this book will help people understand what types of investment risks generate premiums, and which actually will cost you money."

Eric Falkenstein, Author of ‘The Missing Risk Premium’: Why Low Volatility Investing works, USA

“Explaining a financial theory to a broad audience is no easy task, and refuting one of the oldest and best known investment theories: higher risk for higher returns, harder still. But Pim (and Jan) manage to convince the reader in this easy to read and accessible book of their approach. They not only explain low-risk investing, but offer readers a whole set of investment (and even life) lessons at the same time. I would recommend every investor read this book. It may not turn all readers into low-risk investors, but it certainly will offer valuable insights into the risk/return question.”

Ronald van Genderen, CFA, Manager Research Analyst at Morningstar, The Netherlands

The Illustrations

Sometimes a picture is worth a thousand words. In order to explain the remarkable stock market paradox of low risk stocks beating high risk stocks in the best possible way, the book contains a lot of beautiful illustrations and graphs created by graphs illustrator Ron Offermans.

The Authors

Pim van Vliet, PhD is the founder and fund manager of the multi-billion Conservative Equity funds at Robeco. These low-risk funds are based on academic research and provide investors with a stable source of income from the stock market. He is a guest lecturer at several universities, the author of numerous financial publications and he travels the world advocating low-volatility investing. Pim holds a PhD and an MSc (cum laude) in Financial Economics from Erasmus University Rotterdam.

Jan de Koning, CFA, CAIA, CIPM, CMT is head Quantitative Client Portfolio Management at Robeco and an expert in the field of quantitative equity strategies. Before joining Robeco, Jan worked as fiduciary manager for Dutch pension funds and insurance companies and was a fund manager at Somerset Capital Partners as well as investment advisor at Van Lanschot Bankiers. Jan holds a MSc from Tilburg University and is a CFA®, CAIA, CIPM and CMT charter holder.

The Screeners

Your Review

Have you read the book? If your answer is 'Yes', we hope you liked it and are able and willing to practically implement this prudent investment philosophy. We're grateful you have taken the time to 'listen' to the story of this remarkable investment paradox. We're interested to receive your feedback as it may inspire other investors as well to become a tortoise-like investor! Please submit your review on the website of Amazon (for eBook/Kindle, click here), Barnes & Noble, !ndigo or Bol.com (in Dutch). If you would like to share private feedback, please feel free to do so by our contact form.

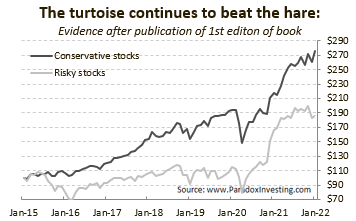

Data updated

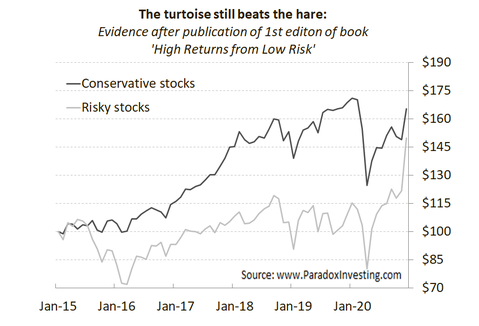

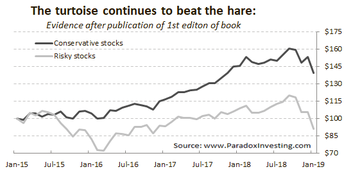

Since the publication of the first edition of the book we have maintained a dataset that highlights the returns of Conservative and Risky stocks. Since 2015 the tortoise continues to beat the hare, despite the fact the hare seems to have had some extra energy over the last few years.

Low Risk investing in 2021: You’re probably feeling like…… a winner!

2021 has been a good year for investors and a perfect year for our low-risk, conservative tortoise fans! After the dismal performance of Conservative stocks in 2020, the tortoises managed to beat the hares in what has been a turbulent year for investors. Global supply chain disruptions, a re-opening of the world economy and a tight US-labor market caused inflation to cascade higher in this year. As a result, investor enthusiasm faded away over the course of the year. High-risk stocks didn’t perform that well in this climate.

Whereas investors still loved high-risk stocks in January and February – remember the Wall Street Bets Mania of young retail investors chasing stocks (or stonks?) of GameStop and AMC! – and Conservative stocks underperformed, the tales turned in the months March, April and May. Low-risk stock started to outperform the high-risk stocks in these months. Especially at the end of the year low-risk stocks managed to perform – from a relative perspective – better than the high-risk stocks of the investment universe. Result? Conservative Stocks staged a 27% return, while high-risk (or risky) stocks only delivered 12%.

Low Risk investing in 2020: You’re probably feeling like…… a loser

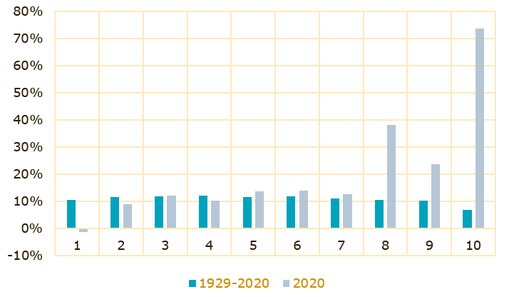

The year 2020 has been a though year for low risk and Conservative investors. Investing in large-cap growth and high-risk stocks turned out to be the best thing an investor could do during this eventful year. In the graphs below we show the returns of the 10 risk sorted portfolios for 2020 and 1929 – 2020 on the left-hand side. Also shown (graph on right) the results of the Conservative stocks (Low Vol + Value + Momentum) since we published the book.

Graphs like these don’t require lengthy technical or academic explanations: high risk aimed for and reached the moon. Low-risk investors were left behind. We explained in the book that moments and years like these could occur. The next few lines copied from the book may help you a bit in these times when everybody is partying on Wall Street with SPACs, crypto’s, stonks and other fancy ‘investments’:

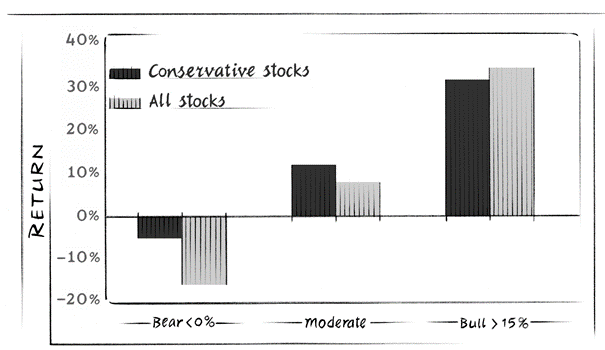

“At such times, when everyone else is celebrating strong market returns of over 15%, you’re probably feeling like…… a loser.

Don’t get me wrong: as an investor in a conservative stock portfolio you would still have made – on average – a handsome one-year profit of over 30%. However, you would have lagged the market. Yes, you did a worse job than the average stock. What’s more at times like these, when stocks seem to only go up and risk taking is amply rewarded, you are holding on to a bag of boring low-risk stocks. Think about it: when you meet your colleagues, friends, or family and they start to talk about their huge successes on the stock market, you’ll have to confess that you are that risk-shunning person who sticks to a conservative stock portfolio. Oh, and most of them won’t even let you finish explaining the long-term benefits of low-risk investing, they‘ll just feel sorry for you. Poor you.”

Time will tell how this frenzy will end and when the hare will get exhausted, but the words of the most famous investor born one year after the start of our long (and updated!) dataset might give some guidance: ‘be fearful when others are greedy and greedy when others are fearful’.

Mission Money: Die 6 besten Bücher, die dir so niemand empfiehlt (12:30)

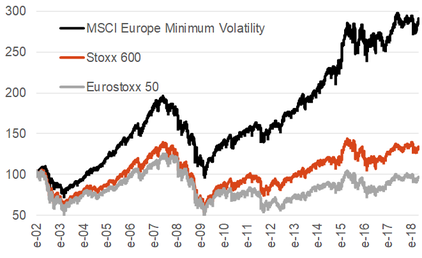

Defensive Aktien: The Conservative Formula für Euro-Anleger

"Defensive Aktien, die anhand der „Conservative Formula“ von Blitz/van Vliet selektiert werden, erwirtschafteten im Euroraum zwischen 1990-2018 eine geometrische Durchschnittsrendite von 13,9% pro Jahr bei reduziertem Risiko. Die Strategie zeigt dabei eine effiziente Exposition zu den etablierten Renditefaktoren, kann aber nicht vollständig durch diese erklärt werden. Das Outperformancepotential offenbart sich besonders in schwierigen Marktphasen und wird vor allem durch die Übergewichtung nicht-zyklischer Branchen getrieben."

Im Rahmen der Rendite/Risiko-Analyse konnte gezeigt werden, dass das resultierende Conservative-Portfolio ein hohes Outperformancepotential mit reduzierter Volatilität und geringerem Downside-Risiko kombiniert. Während der Markt über den Beobachtungszeitraum eine geometrische Durchschnittsrendite von 6,8% pro Jahr erzielte, erreichte das Conservative-Portfolio einen Wert von 13,9% pro Jahr. Dies spiegelt sich entsprechend auch in den risikoadjustierten Renditen wider, die nach Kontrolle für das Marktrisiko bei 8,1% pro Jahr liegen. Die multifaktorielle Analyse hat darüber hinaus dargelegt, dass die Strategie Investoren eine effiziente Faktor-Exposition zu den etablierten Renditefaktoren wie Size, Value, Momentum und Quality bietet, aber durch diese nicht vollständig erklärt werden kann. Es verbleiben auch im Vier- bzw. Sechs-Faktor-Modell signifikant positive Alphas i.H.v. 3,8% bzw. 3,0% pro Jahr. Das Outperformancepotential der Strategie offenbart sich besonders in schwierigen Marktphasen und resultiert vor allem aus einer Sektorallokation, die Unternehmen aus nicht-zyklische Branchen relativ zum Markt übergewichtet”.

Think of the old saying: It's not what you make, but what you don't lose

"Van Vliet and de Koning responded by referring to the fable of the tortoise and the hare. The tortoise is expected to lose the race to the much faster hare. Nevertheless, the tortoise does race, moving slowly and steadily. The hare dashes out ahead of the tortoise, confident it will win easily. It’s so confident it takes a nap and ends up being beaten by the tortoise. That’s the paradox at the core of this book, that a low-risk portfolio beats a high-risk portfolio because it is slow and steady. It never races ahead, but it can recover from market declines more quickly than the high-risk portfolio. Consider just the S&P 500’s loss of 38.5% in 2008. Both high-risk and low-risk portfolios had to recover, and while the authors don’t provide the amounts of the losses in that year, we can be quite sure that the high-risk stocks had a much steeper path to recovery.."

Invertir con la máxima rentabilidad: ¿qué riesgo podemos asumir?

"Cualquier inversión espera un determinado retorno. Una relación en la que se cuela un tercer factor: el riesgo. Su nivel es directamente proporcional al beneficio de la inversión. La premisa es sencilla: a más riesgo, más potencial de ganancia pero, ¿hasta qué punto es aconsejable asumir riesgos para invertir y obtener la máxima rentabilidad? El terreno de la inversión es incierto por lo que es conveniente moverse por él con cautela aunque con la idea de que quien no arriesga, no gana."

Pero ¿existen inversiones con altos rendimientos y bajo riesgo? Sí, al menos es lo que los expertos en inversiones Pim van Vliet y Jan de Koning ponderan en su libro, El pequeño libro de los altos rendimientos con bajo riesgo (Deusto, 2018). Los llaman ‘valores aburridos’, pero son los que la historia ha coronado como los más rentables. Estos holandeses analizaron el comportamiento en el tiempo -desde 1929 hasta 2017- de las acciones más conservadoras y las más arriesgadas del mercado con una sorprendente conclusión. Si en 1929 se hubieran invertido 100 euros en títulos de los considerados ‘aburridos’, hoy se tendría un valor superior a 26 millones de euros, mientras que los valores ‘de riesgo’ sólo habrían dado 780 euros. Este cálculo vuelve a poner de relevancia que no solo el riesgo determina la rentabilidad, sino el criterio, ya que como dijo el sabio financiero Buffett: “El mayor riesgo proviene de no saber lo que se está haciendo”.

5 boeken die van jou een succesvolle belegger maken

"Wil jij je vermogen exponentieel laten groeien door te gaan beleggen? Dan kan je waarschijnlijk wel wat tips van ervaren beleggers gebruiken. Met de expertise beschreven in deze boeken en de inzichten die de schrijvers over beleggen hebben vergaard, wordt jouw succes bijna gegarandeerd na het lezen van onderstaande boeken. Leer van andermans fouten en investeer in je eigen kennis".

Chinese edition of the book: 600+ reviews and counting...

It has been two and a half years ago that we published the first edition of the book on low risk investing with Wiley in the UK. Back in the days Pim and I had the idea to just publish one version of the book as we didn't work with a publishing agent. After all, writing and publishing the book was something we pursued outside working hours and consumed quite a bit of our time and energy.

However, due to the ongoing feedback from colleagues, friends and family and the requests to publish the book in other languages as well we started to publish the book with great publishers as well. Think about a German book with FinanzBuch Verlag, a French edition with Economica in Paris, a Spanish edition with Roger Domingo from Duesto and last year we published the Dutch edition with the fantastic publisher Business Contact. Most of times we received incredible help from colleagues that had a better understanding of Spanish, German or the French language than Pim or I possessed. Take the great Dr. Bernhard Breloer for example: native German speaking 'uber'-quant who normally helps out clients in Germany. Or Weili Zhou, our Chinese Queen of Quant and deputy head quant research at one of the leading quantitative asset managers in the world. She had the great idea to publish the book in Chinese language together with CITIC publishers, one of the largest publishers. Weili did special research on the local Chinese equities market, the A-shares market, and we added that chapter about low-risk investing in China to the book.

Pim and I joked many times that we would be very happy if every Chinese investor would know this book (Pim day-dreamed about early retirement....). Well, frankly, we are not their yet (and who wants to retire anyway if you are enjoying your work?), but the Chinese book turned out to be a bestseller with special fan mail in Chinese and many many reviews on Chinese online retail website JD.com. Within half a year over 600 Chinese readers provided feedback, which resulted in a 5-star rating.

You might wonder: What is your plan with this book? Can we expect an update? Are you going to write more books? Well, our plan was to write a book that would be still relevant if our kids would pick it up on a rainy day and start reading it in 10 or 15 years from now. We provide every year an update of the returns on this website and will continue to publish editions in other languages as well (if a language is missing and you know a great publisher, drop us a line!).

Validea Guru Screener adds High Returns From Low Risk formula

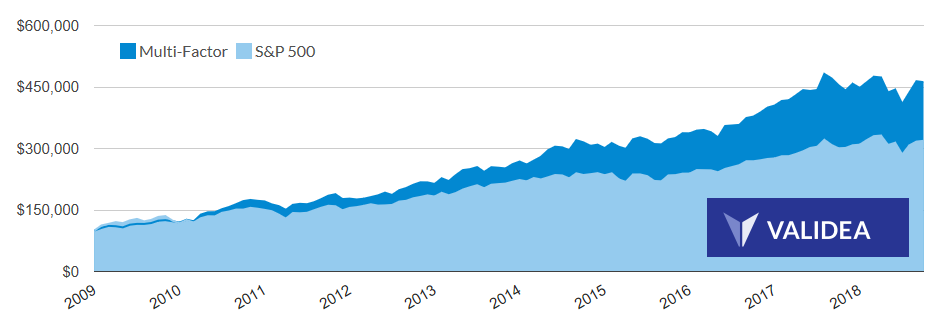

"Validea used the investment strategy outlined in the book High Returns From Low Risk written by Pim van Vliet to create our Multi-Factor Investor portfolio.

Van Vliet's strategy starts by selecting the 1000 largest stocks based on market cap. It then reduces that group further by eliminating the 500 most volatile stocks using standard deviation. The remaining stocks are sorted based on their net payout yield (which looks for firms with high dividends that are also buying back their stock), and their intermediate term momentum (using 12-month momentum excluding the most recent month).

The end result is a group of low volatility stocks that are focused on returning capital to shareholders and have been performing well relative to the market."

Updated dataset available

Did the formula worked in 2018? Does low-risk investing still work in this new era of fintech, cryptocurrencies and 'winner-takes-all' platform economies? See for yourself by downloading the updated dataset which covers 1929 - 1918, almost 90 years of evidence... Have fun!

Robeco slaat gong om aandacht te vragen voor ‘De conservatieve belegger”

"Robeco slaat samen met beleggingsexperts Pim van Vliet en Jan de Koning de gong, en vragen hiermee aandacht voor het beleggingsgedrag van de conservatieve belegger. Van Vliet en de Koning hebben een boek geschreven over laag volatiel beleggen. Hiervan komt midden oktober een Nederlandse vertaling van uit."

Focus: Money Online - Fabelhafte Renditen

"Wer nicht wagt, der nicht gewinnt? Falsch! Wer langfristig erfolgreich sein will, setzt auf Vernunft statt auf Spektakel. FOCUS-MONEY liefert den eindeutigen Beweis Wie an der Schnur gezogen.

Die Historie zeigt: Aktien mit einer geringen Volatilität schneiden langfristig deutlich besser ab als risikoreiche Wertpapiere. Anleger erzielen so deutliche Überrenditen und können ruhiger schlafen. Es waren einmal eine Schildkröte und ein Hase.

Der Hase machte sich Tag für Tag über die Langsamkeit der Schildkröte lustig. Trotzdem wagte sie es, den Hasen zum Wettlauf herauszufordern. Der Hase ließ sich mehr im Scherz als aus Prahlerei darauf ein. Als der Startschuss fiel, sprang der Hase, große Haken schlagend, mit vielen Umwegen los.

Die ganze Zeit über lachte er über die Dummheit der Schildkröte. Und um ihre Niederlage besonders auszukosten, legte er sich kurz vor dem Ziel ins weiche Gras, um dort auf sie zu warten. Die Schildkröte kroch unermüdlich voran. Als sie sich dem Ziel näherte, sah sie den Hasen im Gras, doch sie ließ sich nicht beirren. Sie kroch weiter, und tatsächlich ging sie als Erste über die Ziellinie!"

Beter beleggen met de kwantformule van Robeco

"Het kon niet uitblijven. Na Graham’s formule en de Magic Formula, daar is ie dan: de kwantformule. Dat wil zeggen de simpele kwantitatieve formule van Robeco. Naar verluidt zou elke belegger hiermee uit de voeten moeten kunnen. We namen de proef op de som.

Al in 1934 drukte Benjamin Graham, de leermeester van Warren Buffett, in zijn boek Security Analysis beleggers op het hart de financiële positie van bedrijven zorgvuldig te bestuderen. Enkel de aandelen die onder hun intrinsieke waarde noteren, beschikken door hun onderwaardering over een veiligheidsmarge en zijn dus geschikt als investering."

Una verdad incómoda - David Cano

"Este libro trata de inversores y de mercados que no siempre se comportan según la teoría. Esta es la historia de una verdad incómoda: cómo las acciones de bajo riesgo (la tortuga) baten a las de alto riesgo (la liebre). Sirve para conocer una de las principales anomalías en los mercados financieros: la relación entre riesgo y rentabilidad no solo no es lineal sino que en ocasiones se hace negativa (sobre todo cuanto mayor es el riesgo). Ataque frontal al CAPM (Capital Asset Pricing Model)."

Fortune Financial's Lawrence Hamtil interviews Pim van Vliet

"Over the last few years, Lawrence has written several times about the myth of more risk equaling more reward, explaining that, historically, the opposite has been true: low-volatility sectors and strategies have outperformed more volatile sectors and strategies.

Lawrence: "In January, after publishing "Why Low-Vol Strategies Make Sense Now", I was pleasantly surprised by an email from Jan de Koning of Robeco in the Netherlands, who, along with Pim van Vliet, PhD, manages a multi-billion dollar fund based on the low-volatility 'paradox.' Jan had come across my article, and was kind enough to share the knowledge on low-volatility investing that he and Pim have accumulated over the years. To make a long story short, Jan and Pim are experts on low-volatility investing, and after reading their wonderful book on the topic, I invited them to do a brief Q&A about their findings, which Pim was kind enough to do here."

Este libro revela una historia sobre el mercado de valores que cambiará la visión que tienes de la inversión - Review El Mundo Financiero

"¿Qué es lo que ocurre? Muchos inversores no lo han advertido hasta ahora, porque siempre han adoptado un enfoque a corto plazo en lugar de uno a largo plazo, quizás por la trampa del bonus anual. Una vez te has dado cuenta de que sólo necesitas una cantidad moderada de riesgo en tu cartera y mantienes una visión a largo plazo, automáticamente estarás menos inclinado a consultar los precios de las acciones, a esperar las últimas noticias, a operar con frecuencia, etc.

Este libro revela una historia sobre el mercado de valores que cambiará la visión que tienes de la inversión. Es una historia sobre la paradoja con la que tropezaros los autores hace muchos años. Es la historia de una “verdad incómoda” para los profesores de economía, puesto que desbarata totalmente sus modelos."

Las acciones de bajo riesgo te hacen rico, las de alto riesgo te hacen pobre - interview with La Informacion

"A la hora de invertir, todos damos por hecho que al hacer apuestas más arriesgadas se pueden obtener mayores ganancias. Pero no es cierto. Como explican los profesores holandeses Pim Van Vliet y Jan de Koning en El pequeño libro de los altos rendimientos con bajo riesgo (Deusto) invertir en una cartera de baja volatilidad es, a la larga, más rentable que hacerla en una de alto riesgo.

Y es algo que, aseguran, han comprobado tras años y años de estudios cuantitativos. De Koning, que trabaja junto a Van Vliet en el fondo de inversión Robeco, ha contestado a las preguntas de La Información."

Blog by Rafael Damborenea on Finect website

"Aprovechando que viene un fin de semana de lluvias y frío en la mayor parte de España, puede ser una buena idea quedarse en casa y disfrutar de una buena lectura. El último libro que he leído, y al que hace honor el título del artículo, está escrito por Pim van Vliet y Jan de Koning (ambos trabajadores de Robeco). Se llama El pequeño libro de los altos rendimientos con bajo riesgo y fue publicado por Deusto el pasado 30 de enero.

Aunque el título pueda llevar a pensar que se trata del enésimo intento de vendernos el Santo Grial de la inversión, nada más lejos de la realidad: es una lectura amena, divertida y que demuestra al lector que, a largo plazo, las acciones de baja volatilidad son mucho más rentables que las de alta volatilidad.

La teoría moderna de gestión de carteras, muy presente en cualquier carrera, postgrado o certificación profesional del ámbito financiero, viene a decirnos que, a mayor riesgo, mayor será la rentabilidad. Y es aquí donde van Vliet explica la paradoja de los altos rendimientos con bajo riesgo."

Cómo mejorar su cultura financiera para tomar decisiones acertadas con su dinero - Periodista Digital

"Existe la creencia generalizada de que, cuanto más arriesgadas son las inversiones, mayores serán los beneficios. Pero es justo lo contrario, aunque contradiga la intuición y lo que se estudia en las escuelas de negocios.

Las acciones de bajo riesgo son las que pueden hacerte rico, mientras que las que comportan mucho riesgo es probable que te lleven a la ruina, tal y como Van Vliet y De Koning demuestran de manera convincente y con una gran cantidad de datos sólidos y fiables que abarcan casi un siglo de operaciones bursátiles.

De hecho, invertir en una cartera de baja volatilidad es más rentable que hacerlo en una de alta rentabilidad. Muchos inversores no lo han advertido hasta ahora porque siempre han adoptado un enfoque a corto plazo en lugar de uno a largo plazo, y han pasado por alto lo que Albert Einstein llamó la octava maravilla del mundo: los rendimientos compuestos, es decir, los rendimientos sobre rendimientos previos."

Las bolsas vuelven a la irracionalidad - La Vanguardia

"Albert Camus solía repetir que todo lo que había aprendido de los hombres y de la moral lo había aprendido en el fútbol. Jan De Konig, coautor de El pequeño libro de los altos rendimientos con bajo riesgos (Deusto 2018), especialista en estrategias de inversión en la firma holandesa Robeco, también ha aprendido mucho del fútbol a la hora de invertir. Después de la volatilidad de esta semana, su esquema en la pizarra es el siguiente: “Para ganar, no puedes llenar el equipo de atacantes como Messi. Tienes que pensar en tener una buena defensa”, explica. “En las bolsas, muchos inversores cometieron este error. Creyeron que al apostar en firmas glamurosas y de alto crecimiento como Alibaba o Tesla tendrían la victoria asegurada. Pero no”. Para De Konig, hubiera sido más prudente apostar, desde el principio, en compañías “aburridas”, como eléctricas, telecomunicaciones o materiales químicos, es decir, firmas que no son cíclicas."

High Returns Low Risk – The Low Vol Anomaly: The Seven Circles

"Today’s post is a first look at a popular book from last year – High Returns from Low Risk – and at the low volatility anomaly it describes. It sounds too good to be true, doesn’t it? But for once it isn’t. The book is written by Pim Van Vliet and Jan De Koning, and looks at one of the most recently discovered – or more accurately, most recently publicized – market paradoxes.

The Best Trading Books of 2017 by Traderlife.co.uk

Hannah Langworth: "Looking for something to add to your Christmas list? Well here are six books published in the last twelve months that are well worth a read over the holidays – plus one to look out for in the new year.

Think that you have to invest in high-risk assets to get high returns? Think again, says this book. “In life you should try to find the optimum between too little and too much,” say the authors, and claim that this applies to investment risk too. Chosen carefully, a portfolio of low-risk assets can actually outperform high-risk ones, they argue, giving traders access to the investment holy grail of great returns with minimal exposure."

Book review in El Economista by Javier Lopez Bernardo, Ph.D, CFA

La ciencia económica, o la ciencia lúgubre como la apodó el historiador Thomas Carlyle en el siglo XIX, ha basado su desarrollo sobre el principio de la escasez de recursos. Una gran parte de la teoría económica moderna está basada en el axioma de la asignación eficiente de recursos y su implicación para el bienestar de una sociedad.

Desde este punto de vista, una de las frases favoritas de los economistas es que no hay “nada gratis” (free lunch): los recursos destinados a un uso tienen que ser sustraídos de otro. Dichos axiomas de la ciencia económica se extrapolaron en la década de 1950 a la teoría financiera gracias a la teoría de carteras de Harry Markowitz. En dicha teoría, el axioma de que no hay nada gratis se aplica al rendimiento de los activos financieros: dicho rendimiento es proporcional al nivel de riesgo asumido (medido por la volatilidad de los precios), con lo que si se quieren obtener retornos superiores en mercados eficientes hay que asumir mayores volatilidades.

#1 Position on the Top 10 Must Read Finance Books of 2017

Finance Monthly has heard from Tamir Davies, content writer and researcher for Savoy Stewart, on the top 10 finance based books to look out for this year, a little about each and which reader they are best suited to.

Tackling the subject of ‘finance’, no matter your aim or venture, can be a difficult feat. It is a tricky topic to get your head around, even if you consider yourself an expert, and as the saying goes ‘knowledge is power’. One traditional way of acquiring this knowledge is by reading. You may be a solicitor, accountant, commercial property investor or CFO, but the ultimate aim is the same – to better yourself in the financial world and to make a return on investment.

1. High Returns from Low Risk: A remarkable Stock Market Paradox by Pim Van Vliet

Traditionally, investors used to view low-risk stocks as safe but unprofitable. And of course profitability is the most important aspect of financial investment. However, this is now a flawed theory. This book, explores how low-risk stocks are actually proving to be far more beneficial, and can outperform high-risk stocks. If you used to believe, the higher the risk, the greater the reward – this old axiom is holding you back. Who’s it for: If you have money and want to know where to put it, with maximum return. Suitable for investors, those in private equity and property investment.

Conservative Formula available at ValueSignals.com

As of today investors can screen for stocks that offer high returns from low risk by using the screener of ValueSignals.com.

Charles Sizemore reviews the book

"Van Vliet and de Koning found that, over the past 86 years, a portfolio of the least volatile stocks (lowest decile) outperformed a portfolio of the most volatile stocks (highest decile) with annualized returns of 10.2% and 6.4%, respectively.

Van Vliet and de Koning are anomaly hunters, and I would include them among the growing evidence-based “smart beta” movement that seek to build a better mousetrap than traditional cap-weighting indexing."

Book review in the Financial Times - FTAdvisor

"I am always keen to consider and understand new investment strategies. Exposure to a wide range of views and opinions is an important factor in allowing me to continue to deliver robust financial advice.

I am therefore pleased to have taken time to read High Returns from Low Risk. Heavy with paradox, I think overall the text is aimed at the do-it-yourself investor who is comfortable and confident to make longer term investment choices with the aim of re-investing income/returns to achieve effective/rewarding compounding – indicated as the eighth wonder of the world."