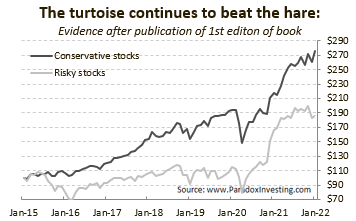

2021 has been a good year for investors and a perfect year for our low-risk, conservative tortoise fans! After the dismal performance of Conservative stocks in 2020, the tortoises managed to beat the hares in what has been a turbulent year for investors. Global supply chain disruptions, a re-opening of the world economy and a tight US-labor market caused inflation to cascade higher in this year. As a result, investor enthusiasm faded away over the course of the year. High-risk stocks didn’t perform that well in this climate.

Whereas investors still loved high-risk stocks in January and February – remember the Wall Street Bets Mania of young retail investors chasing stocks (or stonks?) of GameStop and AMC! – and Conservative stocks underperformed, the tales turned in the months March, April and May. Low-risk stock started to outperform the high-risk stocks in these months. Especially at the end of the year low-risk stocks managed to perform – from a relative perspective – better than the high-risk stocks of the investment universe. Result? Conservative Stocks staged a 27% return, while high-risk (or risky) stocks only delivered 12%.