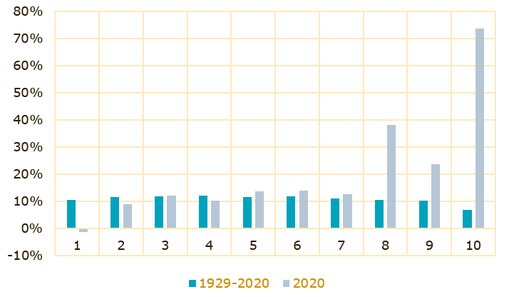

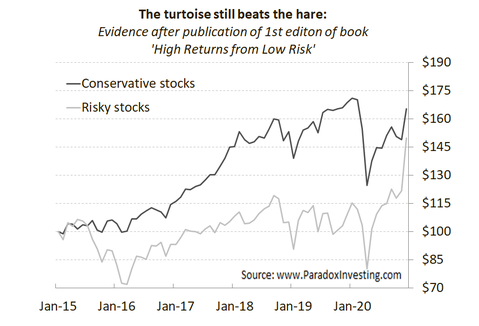

The year 2020 has been a though year for low risk and Conservative investors. Investing in large-cap growth and high-risk stocks turned out to be the best thing an investor could do during this eventful year. In the graphs below we show the returns of the 10 risk sorted portfolios for 2020 and 1929 – 2020 on the left-hand side. Also shown (graph on right) the results of the Conservative stocks (Low Vol + Value + Momentum) since we published the book.

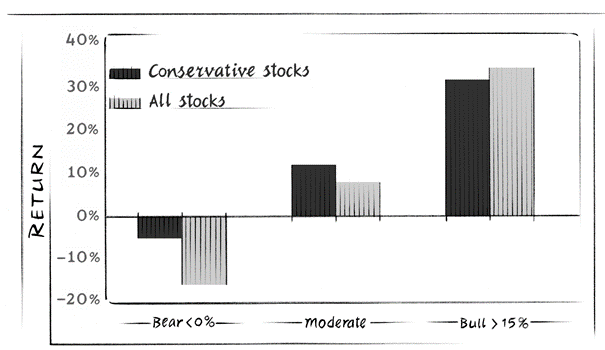

Graphs like these don’t require lengthy technical or academic explanations: high risk aimed for and reached the moon. Low-risk investors were left behind. We explained in the book that moments and years like these could occur. The next few lines copied from the book may help you a bit in these times when everybody is partying on Wall Street with SPACs, crypto’s, stonks and other fancy ‘investments’:

“At such times, when everyone else is celebrating strong market returns of over 15%, you’re probably feeling like…… a loser.

Don’t get me wrong: as an investor in a conservative stock portfolio you would still have made – on average – a handsome one-year profit of over 30%. However, you would have lagged the market. Yes, you did a worse job than the average stock. What’s more at times like these, when stocks seem to only go up and risk taking is amply rewarded, you are holding on to a bag of boring low-risk stocks. Think about it: when you meet your colleagues, friends, or family and they start to talk about their huge successes on the stock market, you’ll have to confess that you are that risk-shunning person who sticks to a conservative stock portfolio. Oh, and most of them won’t even let you finish explaining the long-term benefits of low-risk investing, they‘ll just feel sorry for you. Poor you.”

Time will tell how this frenzy will end and when the hare will get exhausted, but the words of the most famous investor born one year after the start of our long (and updated!) dataset might give some guidance: ‘be fearful when others are greedy and greedy when others are fearful’.