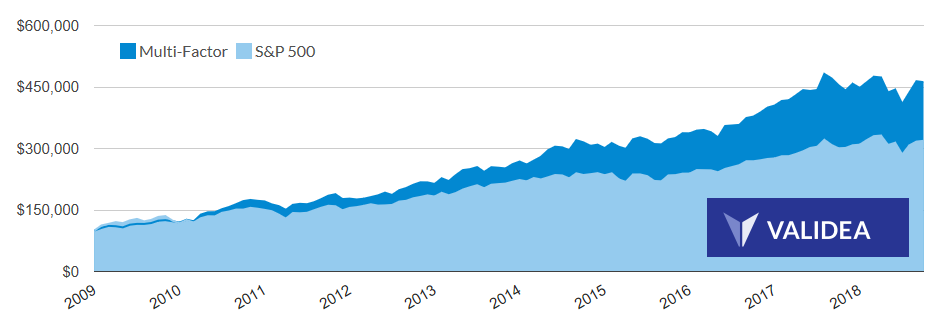

"Validea used the investment strategy outlined in the book High Returns From Low Risk written by Pim van Vliet to create our Multi-Factor Investor portfolio.

Van Vliet's strategy starts by selecting the 1000 largest stocks based on market cap. It then reduces that group further by eliminating the 500 most volatile stocks using standard deviation. The remaining stocks are sorted based on their net payout yield (which looks for firms with high dividends that are also buying back their stock), and their intermediate term momentum (using 12-month momentum excluding the most recent month).

The end result is a group of low volatility stocks that are focused on returning capital to shareholders and have been performing well relative to the market."